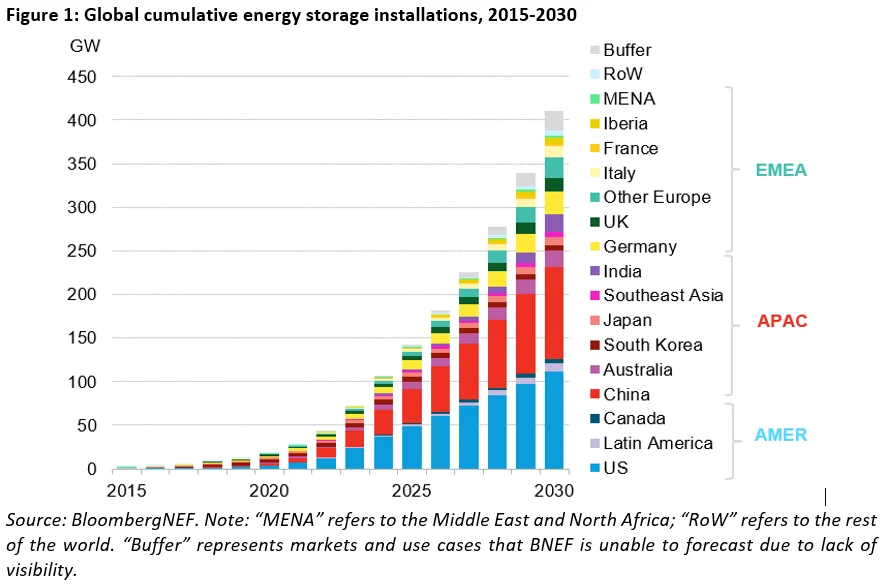

According to the latest forecast of the research firm BloombergNEF (BNEF), by the end of 2030, the global energy storage installations are expected to reach 411 GW (or 1,194 GWh), and the newly installed capacity will reach 88GW/278GWh. The two largest markets account for more than half of global storage installations, but Europe is catching up to the massive capacity growth fueled by the current energy crisis.

According to the Bloomberg New Energy Finance 1H23 Energy Storage Outlook, the energy storage market is growing strongly at a compound annual growth rate of 23%, with multiple markets announcing a target of more than 130 GW of total energy storage by 2030, and government entities around the world also approving millions of dollars in storage development subsidies. These subsidies boost deployment but also highlight potential challenges where batteries are not yet economically attractive in much of the world.

The Russian invasion of Ukraine has had a clear impact on energy storage deployments in Europe. Record electricity prices are forcing consumers to consider new forms of energy supply, driving the residential energy storage market in the short term. Global energy markets were already struggling with supply issues even before Russia invaded Ukraine, with governments pushing for an energy transition. The war in Ukraine has sent oil and gas prices soaring, and governments are racing to build more wind and solar power to reduce their reliance on fossil fuels. The British government plans to install 50GW of offshore wind power by 2030. Under the new REPowerEU scheme, the EU plans to install 525GW of solar by 2030.

In the U.S., the Biden administration is spending billions of dollars on new capacity and grid upgrades. The Americas region will account for 21% of annual energy storage capacity (in GW terms) by 2030. The U.S. is by far the region’s largest market, led by a string of large-scale projects in California, the Southwest and Texas, the report noted. It is expected that by 2030, China will overtake the United States as the largest energy storage market on a megawatt scale.

From a regional perspective, by 2030, driven by China’s rapidly expanding market, the Asia-Pacific region will lead the construction of megawatt-level storage. But the Americas will add more capacity on a MWh basis, because energy storage plants in the U.S. typically have more storage time. The Middle East and Africa will still lag behind its peers.

By 2030, the majority of energy storage build-outs (equivalent to 61% of MW) will be used to provide so-called energy shifting, in other words, advancing or delaying the timing of electricity dispatch. Co-construction of renewable energy + energy storage projects, especially solar + energy storage projects, has become commonplace around the world. Including residential, commercial and industrial are also expected to grow steadily. Germany and Australia are currently the leaders in this field, and Japan and California also have sizeable markets. It is predicted that by 2030, energy storage installations in homes and businesses will account for about a quarter of the world’s energy storage installations.

Rapidly evolving battery technology is driving the energy storage market. Lithium-ion batteries currently make up the majority of installations, but many non-battery technologies are being developed, such as compressed air and thermal energy storage. Nonetheless, BNEF expects batteries to dominate the market until at least the 2030s, largely due to their price competitiveness, mature supply chain and proven track record. If the new technology manages to outperform lithium-ion batteries, the total amount of energy storage is likely to be even greater.

Post time: Sep-20-2023