In 2022, the energy storage industry will develop vigorously, and the cumulative installed capacity of new energy storage will reach 13.1GW. The number of new energy storage projects planned and under construction in China has reached nearly 100GW, which has greatly exceeded the scale expectation of 30GW in 2025 put forward by relevant national departments. 2023 will undoubtedly be another year of continuous rapid growth of domestic electrochemical energy storage.

The new energy storage industry is full of vigor and vitality, hope and challenge coexist. Energy storage should develop in the direction of large-scale, medium-to-long term, strong tolerance and high safety performance. In recent years, electrochemical energy storage accidents have occurred frequently. How to solve the safety management of energy storage?

Liquid cooling has become a popular technology route in the thermal management track, and liquid cooling has recently frequently refreshed the screen. In April, Midea released its energy storage system solutions and a variety of new liquid-cooled energy storage thermal management products for the first time, officially entering the segmented track of energy storage thermal management; Huadian Group launched a new round of centralized procurement of lithium iron phosphate energy storage systems , purchased 2GWh of air-cooled energy storage systems and 3GWh of liquid-cooled energy storage systems.

What kind of track is liquid cooling energy storage?

01 Energy storage thermal management

Because of the thermal characteristics of batteries, thermal management has become a key link in the electrochemical energy storage industry chain. From the perspective of the value and volume of the industrial chain, battery costs account for about 55% of the energy storage system, PCS accounts for about 20%, BMS and EMS account for about 11%, and thermal management accounts for about 2%-4%. The value of thermal management is relatively low, but it plays a vital role and is the key to ensuring the continuous and safe operation of the energy storage system.

Power station accidents occur frequently, and lithium battery thermal runaway is one of the main reasons for energy storage system safety accidents. The energy storage system generates a lot of heat and has limited space for heat dissipation. It is difficult to achieve temperature control under natural ventilation, and it is easy to damage the life and safety of the battery. Compared with the power battery system, the batteries of the energy storage system have higher power, more quantity, and stronger heat generation, and the tight arrangement of the batteries leads to limited heat dissipation space, making it difficult to dissipate heat quickly and evenly, which may easily cause friction between the battery packs. Heat accumulation and excessive operating temperature difference lead to frequent safety accidents of the energy storage system, which will eventually damage the life and safety of the battery.

Li-ion battery thermal runaway process

Thermal management is the key to ensuring the continuous and safe operation of energy storage systems. Ideally, the thermal management design can control the temperature inside the energy storage system in the optimal temperature range (10-35°C) for lithium battery operation, and ensure the temperature uniformity inside the battery pack, thereby reducing battery life decay or heat dissipation. Risk of loss of control.

At present, the mainstream technical routes of energy storage thermal management are air cooling and liquid cooling. Energy storage thermal management technology routes are mainly divided into air cooling, liquid cooling, heat pipe cooling, and phase change cooling, among which heat pipe and phase change cooling technologies are not yet mature.

1. air cooling

The battery temperature is lowered by gas convection. It has the advantages of simple structure, easy maintenance, and low cost, but the heat dissipation efficiency, heat dissipation speed and temperature uniformity are poor. Suitable for occasions with low heat generation rate.

2. liquid cooling

The battery temperature is reduced by liquid convection. The heat dissipation efficiency, heat dissipation speed and temperature uniformity are good, but the cost is high, and there is a risk of cooling liquid leakage. It is suitable for occasions where the battery pack has high energy density, fast charging and discharging speed, and large changes in ambient temperature.

3. Heat pipe & phase change

The heat dissipation of the battery is achieved through the evaporation and heat absorption of the medium in the heat pipe and the phase change conversion of the material.

Among them, the liquid cooling technology directly dissipates heat through liquid convection, which can realize precise temperature control of the battery and ensure uniform cooling. In contrast, the cost of air cooling technology is lower, but the heat dissipation efficiency is not high, and it is impossible to achieve precise temperature control of the battery. Therefore, in low power scenarios, air cooling is still the mainstream, while in medium and high power scenarios, liquid cooling technology occupies a dominant position. The liquid cooling system has the advantages of large specific heat capacity and rapid cooling, which can more effectively control the temperature of the battery, thereby ensuring the stable operation of the energy storage battery.

02 Liquid cooling energy storage market

The domestic energy storage market is booming, and downstream energy storage integrators and battery manufacturers have begun to deploy energy storage liquid cooling technology early, and develop new products and update product iterations with new technologies. With the involvement of more and more practical application projects, liquid-cooled energy storage systems are rapidly becoming the mainstream technology route in the market.

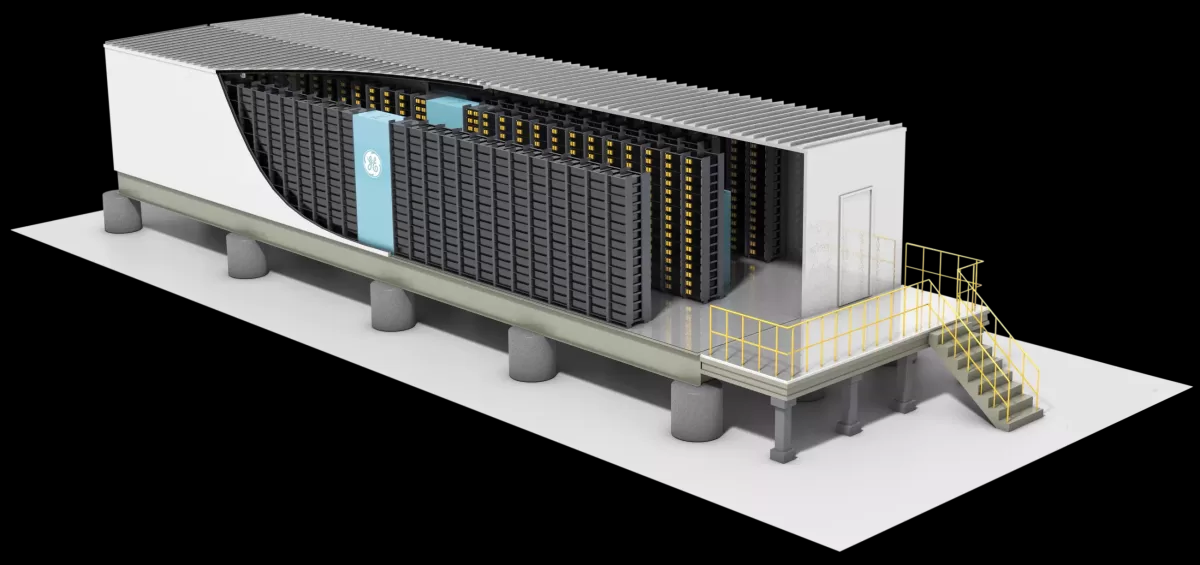

At present, the proportion of liquid cooling technology in new large-scale storage projects on the power generation side/grid side is rapidly increasing, such as the 100MW/200MWh shared energy storage power station demonstration project of Ningxia Power Investment Ningdong Base, Gansu Linze 100MW/400MWh shared energy storage power station project etc. will use liquid cooling temperature control technology. And the application in actual projects is gradually increasing. For example, the Southern Power Grid Meizhou Baohu energy storage power station was officially put into operation in Wuhua County, Meizhou City, Guangdong Province recently. This is also the world’s first submerged liquid-cooled energy storage power station. For the first time, China Southern Grid Energy Storage Company directly immersed the battery in the coolant in the cabin to achieve direct, rapid and sufficient cooling and cooling of the battery to ensure that the battery operates within the optimum temperature range.

Large energy groups have started bidding for liquid-cooled energy storage systems. According to statistics, China National Nuclear Corporation, PetroChina, National Energy Group, Huadian Group and other companies have carried out liquid-cooled energy storage system procurement projects. The scale of the liquid-cooled system is about 5.4GWh, and the purchase unit price is in 1.42 yuan/Wh-1.61 yuan/Wh.

According to public information statistics, Kehua Data Energy, Sungrow Power, Yiwei Lithium Energy, Cairi Energy, Xingyun Times, HyperStrong, Haichen Energy Storage, Zhongtian Technology, Shanghai Electric Guoxuan, Trina Energy Storage, Ashi Dozens of manufacturers, such as Te and Shenghong, followed the trend of liquid cooling. The new products released all involve liquid cooling technology, covering various scenarios such as power grid level, industrial and commercial, and household energy storage.

For temperature control equipment companies, their core competitiveness will be reflected in customization capabilities, as well as long-term experience and technical accumulation in thermal management solutions. GGII believes that the medium and long-term market distribution will focus on companies with more mature customized designs, better non-standard designs and higher cost-effective products. Therefore, for temperature control equipment companies, their core competitiveness will be reflected in customization capabilities and long-term experience accumulation, especially in thermal management solutions.

03 Future potential of liquid cooling energy storage

The explosion of the energy storage market will continue. In order to effectively promote the consumption of new energy power, the release of large-scale and high-capacity energy storage power stations is accelerated. As an important part of the energy storage system, the thermal management system will benefit from the increase in the installed capacity of energy storage. The scale of the energy storage temperature control market may continue to expand .

According to statistics, in 2022, China’s new energy storage projects will reach 7.3GW/15.9GWh, and the cumulative installed capacity will reach 13.1GW/27.1GWh. Combined with the planning situation of various regions, it is estimated that by the end of 2025, the cumulative installed capacity of domestic energy storage is expected to reach nearly 80GW. According to the analysis of the Advanced Industry Research Institute (GGII), the value of domestic energy storage temperature control shipments will reach 16.5 billion yuan in 2025. With the increase in energy storage capacity and charge-discharge rate, the proportion of medium and high-power energy storage products using liquid cooling will increase. Gradually improving, liquid cooling is expected to become the mainstream solution in the future, and the penetration rate of liquid cooling technology is expected to reach about 45% by 2025.

Forecast of China’s energy storage temperature control and liquid cooling market (100 million yuan)

In the future, as new energy power stations and off-grid energy storage require larger battery capacity and higher system power density, the proportion of liquid-cooled energy storage will become larger and larger, and it will surely become a leader in the energy storage market by virtue of its comprehensive advantages. mainstream. It will stimulate energy storage system manufacturers’ enthusiasm for continuous deployment of new products and new technologies, and promote the safety and economical improvement of energy storage systems.

Post time: Sep-22-2023